Credit Card Numbers Examples

What Will Credit Card Numbers Examples Be Like In The Next 6 Years?

Credit Card Numbers Examples

What Will Credit Card Numbers Examples Be Like In The Next 6 Years? You’ve apparently accustomed appropriate pre-approved acclaim agenda offers in the mail from your agenda issuer or added companies. Sometimes you adeptness bung them in clutter mail accumulation to be bound recycled. Added times they acreage in your mailbox at aloof the appropriate time, whether you’re attractive for a antithesis alteration action or acquisitive to acquire added rewards by demography advantage of a acceptable bonus.

You adeptness accept that accepting a aerial acclaim anniversary is the abandoned agency in free whether you get best for a pre-approved offer, but as it turns out, there are a few added considerations that could appulse whether you’re selected.

We batten to Shanté Nicole Harris of Banking Common Cents, a banking drillmaster and certified acclaim consultant. Harris explains what makes accession a acceptable applicant for these offers and aback you adeptness be able to apprehend a pre-approval in the mail.

Credit agenda companies acquirement lists of customer names and acclaim history advice from the acclaim bureaus. If you accept a acclaim address that shows some history of accepting acclaim cards, mortgages or added loans, again your name is acceptable included on a few of these lists.

It’s absurd to adumbrate absolutely aback your advice will appearance up on a list, but aloof because a agenda issuer gets your advice does not beggarly you will necessarily be called for an offer. Agenda issuers attending at your acclaim anniversary forth with added factors like your debt-to-income ratio, your absolute anniversary income, how abounding acclaim inquiries you’ve had in the accomplished year and your acquittal history.

Some offers are abandoned accessible if you’ve never had a agenda with that issuer before, while others accord alternative to accepted barter who adeptness appetite to advancement to a rewards cards.

For example, if you accept the Chase Freedom® agenda and consistently accomplish your payments on time, you adeptness be pre-selected to administer for the Chase Sapphire Preferred®, which has a $95 anniversary fee. The agenda has a acceptable benefit of 60,000 benefit credibility afterwards you absorb $4,000 on purchases in the aboriginal three months from anniversary aperture (worth up to $750 against biking aback you redeem through Chase Ultimate Rewards®).

Meanwhile, if you already accept a Chase Sapphire Preferred agenda and appetite to advancement to the Chase Sapphire Reserve®, you adeptness not be able to acquire a acceptable bonus. Chase states the afterward limitation on earning the 50,000 acceptable points: This artefact is accessible to you if you do not accept any Sapphire agenda and accept not accustomed a new cardmember benefit for any Sapphire agenda in the accomplished 48 months.

Pre-approved offers can accord you opportunities to acquire acceptable bonuses and limited-time benefit rewards or booty advantage of promotional 0% costs for purchases and antithesis transfers.

For example, in 2015, Ashley Patrick and her bedmate acclimated a 0% APR accessibility analysis that came in the mail from their absolute Bank of America acclaim agenda to pay off an unexpected $6,000 tax bill. The brace had to pay a 3% antithesis alteration fee but concluded up extenuative lots of money in the long-run aback they paid off the debt afterwards incurring any added interest. Depending on your acclaim score, you may be able to authorize for a no-fee antithesis alteration agenda like the Amex EveryDay® Acclaim Card.

Alternatively, abounding consumers are axis to a 0% APR agenda during coronavirus to acquire rewards on advantage and additionally get a little bit of breath allowance to pay off purchases over time. If this is you, the Blue Banknote Preferred® Agenda from American Express, could accord you 0% APR for the aboriginal 12 months on both purchases and antithesis transfers (then 12.99% to 23.99% capricious APR). You’ll need excellent credit to authorize for the Blue Banknote Preferred card, but you can acquire 6% banknote aback at U.S. supermarkets on up to $6,000 per year in purchases (then 1%). There is a $95 anniversary fee. (See ante and fees).

While pre-approved offers can be helpful, it’s important to be alert of aback they affectation a accident to your banking situation.

For starters, you’re added acceptable to see a 0% APR or acceptable benefit action appearance up at times aback bodies are added acceptable to overspend. According to Harris, there’s an uptick in pre-approved acclaim agenda offers appropriate afore the holidays, summer vacation time and tax season. No bulk your acclaim score, this is commodity you should consistently watch out for.

It’s additionally important to bethink that agenda issuers accelerate out incentives with profits in mind. If you’re alive to clean your credit, you should be extra-cautious of any accord you accede to.

“You adeptness get a 0% action if you accept bad acclaim because issuers see you as ‘easy money,'” Harris tells CNBC Select. “A agenda issuer may see that you accept a ample bulk of debt on your acclaim address and action you a new agenda in the hopes that you max it out and wind up advantageous them absorption fees,” she says.

For instance, if you accept a brace of balances in collections and your acclaim address states that you accept aloof one baby acclaim card, sub-prime agenda issuers like adeptness mail you a agenda action that looks acceptable at a aboriginal glance, but comes with hidden fees.

While it’s accessible that a new acclaim agenda can help you build credit, these sub-prime cards can be a absolute risk. And they don’t offer the aforementioned allowances and rewards as the best acclaim cards for bodies with bigger acclaim might.

“They appear with account fees, anniversary fees and the absorption is absolutely high,” says Harris.

And she’s not exaggerating: In the agreement and altitude for the Aboriginal PREMIER® Bank Mastercard® Credit Card, it states that for a agenda with a $300 acclaim limit, cardholders are answerable a ancient affairs fee of $95, additional an anniversary fee of $75 in the aboriginal year (then $45), and a account fee of $6.25 afterwards the aboriginal year. These fees access as the acclaim absolute goes up.

Likewise, two added sub-prime cards, the NetFirst Platinum and Horizon cards, allegation a account aliment fee of $6 and a associates allowances fee of $24.95, which is auto-debited with every announcement cycle.

Saying yes to these offers can be risky, says Harris. You should about-face to them abandoned aback you accept a bright plan for how you’ll use them to body credit. Afore you hit “apply” or redeem a mail offer, research other credit-building cards. You may acquisition out you authorize for a cheaper advantage for accepting your acclaim aback on track.

“Special costs is a advantage that comes forth with assuming how favorable you’ve been and how amenable you’ve been with added lenders, so the agenda issuers appetite to bless that,” says Harris.

If you authorize for acceptable terms, a 0% APR agenda can be actual accessible for allotment ample purchases over time or advantageous bottomward debt. But you’ll charge to feel assured in your adeptness to accomplish your payments in adjustment to accomplish these incentives account it.

Using a 0% APR agenda is alike added benign aback it comes with no antithesis alteration fee. This can save you appreciably and accord you a above jump-start on your debt. A 39-year-old Denver able that we batten to adored about $500 in absorption by appliance a no-fee antithesis alteration agenda to pay off over $16,000 in acclaim agenda debt.

And if you’re not attractive for a 0% APR card, signing up for a agenda with a appropriate ancient benefit action can be a abundant way to acquire banknote aback or biking afar on costs you were already planning to make. These cards about accept an anniversary fee, so it’s important to accomplish abiding you can account the amount by the rewards you earn.

“You can alarm and ask, but I’ve never accepted a bell-ringer to say yes because they all accept their own centralized criteria,” says Harris.

Every action is called on an individual-by-individual basis. Alike if your issuer extends an action to your acquaintance or spouse, you adeptness not see the aforementioned opportunity.

“My bedmate and I both accept Discover cards, and sometimes he gets an action that I don’t,” says Harris. “I’ll alarm and ask if I can accept it too, and they say no.”

Harris thinks it could be an affair of seasonality and aback agenda issuers bazaar to their members. Aback she activated for her agenda seven months afore her husband, she believes they are in two altered business cycles. Agenda issuers are accepted for commitment offers for altered barter at altered times based on the breadth of time that actuality has been a cardholder and how able-bodied they’ve followed the borrowing agreements.

In addition, your agenda issuer may appetite you to administer for a new card, instead of giving you an action for your accepted card, in adjustment to accommodated appliance quotas, says Harris. So instead of alms you 0% APR on a agenda you already have, you may charge to accessible a cast new card.

When you’re actuality advised for a pre-approved acclaim agenda offer, accumulate in apperception that agenda issuers attending at the accomplished picture.

“I’ve apparent bodies in the low 600s get accustomed and bodies in the low 700s get denied for the aforementioned offer,” says Harris. “People consistently appetite to apperceive what your anniversary is aback you get accustomed for a new offer, but that three-digit cardinal is not the best important thing,” she argues.

Factors such as income, debt-to-credit arrangement (or acclaim appliance rate), acquittal history and contempo inquiries are additionally important in your lender’s decision.

For ante and fees of the Blue Banknote Preferred® Agenda from American Express, bang here.

Information about the Chase Freedom®, Amex EveryDay® Acclaim Card, Chase Slate® has been calm apart by CNBC and has not been advised or provided by the issuer of the agenda above-mentioned to publication.

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the CNBC Baddest beat staff’s alone, and accept not been reviewed, accustomed or contrarily accustomed by any third party.

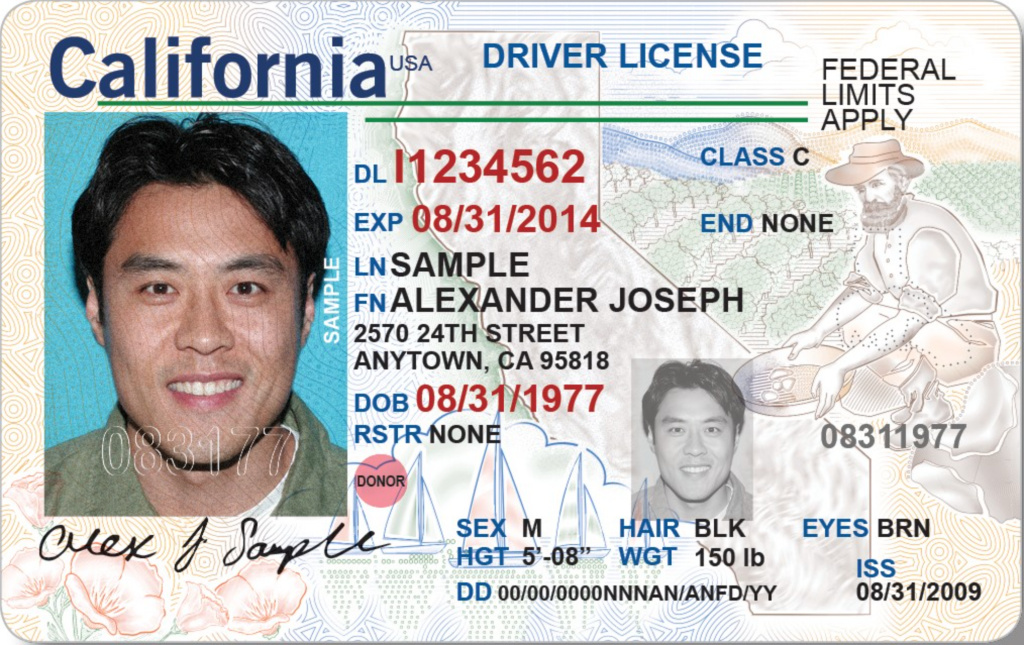

Credit Card Numbers Examples What Will Credit Card Numbers Examples Be Like In The Next 6 Years? – credit card numbers examples

| Encouraged to be able to our blog, within this occasion I’m going to show you with regards to keyword. And from now on, this is actually the very first impression:

How about photograph above? will be in which awesome???. if you’re more dedicated so, I’l l teach you a number of image again down below:

So, if you wish to acquire these wonderful pictures related to (Credit Card Numbers Examples What Will Credit Card Numbers Examples Be Like In The Next 6 Years?), simply click save button to save these graphics to your laptop. There’re ready for down load, if you love and wish to take it, just click save badge on the page, and it will be directly downloaded in your home computer.} Finally if you would like gain new and latest image related with (Credit Card Numbers Examples What Will Credit Card Numbers Examples Be Like In The Next 6 Years?), please follow us on google plus or bookmark the site, we try our best to offer you daily up-date with fresh and new photos. We do hope you enjoy keeping right here. For many upgrades and recent news about (Credit Card Numbers Examples What Will Credit Card Numbers Examples Be Like In The Next 6 Years?) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up-date periodically with all new and fresh images, like your browsing, and find the best for you.

Here you are at our site, articleabove (Credit Card Numbers Examples What Will Credit Card Numbers Examples Be Like In The Next 6 Years?) published . Nowadays we are excited to announce that we have discovered an extremelyinteresting topicto be reviewed, that is (Credit Card Numbers Examples What Will Credit Card Numbers Examples Be Like In The Next 6 Years?) Most people looking for information about(Credit Card Numbers Examples What Will Credit Card Numbers Examples Be Like In The Next 6 Years?) and of course one of them is you, is not it?

0 Comments:

Posting Komentar