Chase Credit Card

Learn The Truth About Chase Credit Card In The Next 8 Seconds

Chase Credit Card

Learn The Truth About Chase Credit Card In The Next 8 Seconds Credit Agenda Companies Are Tracking Shoppers Like Never Before

Transactions accept accustomed acceleration to a circuitous data-selling ecosystem. At the affection of it are acclaim agenda processing networks, including Visa V , American Express AXP , and Mastercard MA , the closing of which took in $4.1 billion in 2019—a division of its anniversary revenue—from leveraging its barn of transaction abstracts for casework that accommodate business analytics as able-bodied as accolade programs and artifice detection. And again there are the banks, retailers, acquittal processors, and software companies that empower online transactions. Few acknowledge their methods; some actively conceal their work; all vow that claimed abstracts is anonymized and aggregated, and accordingly secure. [Fast Company]

Your acclaim agenda abstracts is actuality tracked to an alike greater extent

PayPal Processed Added Affairs on May 1 Than on Black Friday

On May 1, PayPal accomplished the better distinct day of affairs in the company’s history, bigger than both Black Friday and Cyber Monday of 2019. April 2020 was additionally a record-breaking ages for PayPal in agreement of acceptance and use. PayPal added 7.4 actor net new alive accounts. PayPal additionally hit a almanac in Q1,adding 10 actor net new accounts, admitting that analeptic was rapidly outshined in April, aback its circadian net new chump bulk averaged almost 250,000 per day and counting. [PYMNTS]

More Americans Using Acclaim Cards Than Banknote for Food

More Americans are relying on credit cards to buy essentials, like groceries, and absorption banknote as the unemployment bulk skyrockets as a aftereffect of the coronavirus pandemic. Overall acclaim agenda spending fell 40% during March and aboriginal April with added Americans at home during the coronavirus, a new address by JP Morgan JPM Chase suggests. Despite beneath acclaim agenda spending, consumers are allotment to pay for abate account items like aliment with acclaim adjoin cash, added abstracts suggests. [Fox Business]

Credit Agenda Issuers Tighten Standards Amid Covid-19 Ambiguity

A address from the Customer Banking Protection Bureau indicates that acclaim agenda applications alone acutely afterwards Covid-19 came to the U.S. In the added anniversary of March 2020, there was already a 6.8% bead in adamantine inquiries for revolving acclaim cards. That jumped to a 39.7% abatement by the end of the month. Consumers became careful about the adherence of their claimed finances, appropriately abbreviation the admiration to get a new acclaim card. Agenda issuers accept additionally pulled aback on their business efforts, absorption on their absolute customers, rather than accepting new ones. [LowCards.com]

JP Morgan’s U.S. Acclaim Agenda Holders Spent 40% Beneath Due to Coronavirus

Credit agenda spending amid some of Chase’s U.S. barter fell 40% during March and aboriginal April compared to aftermost year, as Americans backward home to assure adjoin the atypical coronavirus. Spending on non-essential appurtenances and services, like retail, restaurants, and entertainment, fell acutely beyond assets brackets accounting for about all of the bead in spending during that period. [Reuters]

Prepaid Cards’ Aphotic Underbelly Hides Potential Banking Sector Pain

Prepaid debit cards accept paved the way to cashless arcade and fast, agenda affairs for millions of bodies beyond the world. But there is a aphotic side. Issued by above banks and others, and active on the networks of payments giants like Visa and Mastercard, these prepaid cards are acclimated to acquit the gain of abomination or armamentarium agitator plots. Victims of scams are pressured into handing over hundreds or bags of dollars through allowance cards from iTunes and Google Play. And there is a growing ambit of reloadable debit cards that acquiesce holders of bitcoin and added cryptocurrencies to absorb their funds in the absolute economy, with no absolute way of alive whether those funds are the gain of adulterous activity. [S&P Global]

Mastercard Says New Abstracts Appearance Spending Headed Adjoin Normalization Phase

New arrangement abstracts from Mastercard appearance U.S. switched aggregate is off 6% year-over-year for the anniversary catastrophe May 7 compared with a 26% abatement in the anniversary catastrophe April 30. Afterwards several months of declines in customer and business spending due to authoritative lockdown orders common to ascendancy the Covid-19 pandemic, Mastercard now says the abridgement may be affective from what it calls “stabilization” adjoin “normalization” as restrictions gradually affluence in abounding places. [Digital Transactions]

Big Banks Built a $35 Billion Fortress to Assure Adjoin Coronavirus Bankruptcies and Defaults

Officials in Washington are aggravating adamantine to abbreviate the bulk of bankruptcies, defaults and foreclosures acquired by the coronavirus pandemic. America’s big banks are planning for the affliction anyway. Bank of America BAC , JPMorgan Chase, Citigroup C , Wells Fargo WFC and US Bancorp USB have set abreast an added $35 billion during the aboriginal division to beanbag adjoin loans that go bust, according to a account by Edward Jones. That aberrant sum underscores the consequence of the bread-and-butter shock, all-inclusive ambiguity over the appearance of a accretion and a new accounting accepted that requires banks to activity losses over the activity of loans. [CNN Business]

Discover Extends EMV Accountability Date for Gas Stations until April

Discover is extending its EMV artifice accountability date, for automatic ammunition dispensers, for six months from Oct. 16 this year until April 16, 2021. The action is to accommodate some abatement to merchants due to the COVID-19 pandemic. The move follows agnate accomplishments appear by American Express and Visa beforehand this month. Ammunition merchants had requested an addendum on the borderline to advancement acquittal systems due to the banking appulse of the pandemic. [Mobile Payments Today]

Divorce Can Cause Your Acclaim Account to Plummet. Take These 4 Steps Beforehand

There are abounding affecting decisions to cross aback advancing for a divorce, but one of the aboriginal things you’ll appetite to pay abutting absorption to is your credit. According to a 2019 analysis by Debt.com with Moneywise.com, 38% of respondents appear that they saw their acclaim account bead by added than 50 credibility afterwards amid from their partner. [CNBC]

Will Coronavirus Hardship Assistance Programs Hurt My Credit?

Millions of Americans are disturbing to pay their bills afterwards they were accidentally affected out of assignment by the COVID-19 pandemic. Banks, acclaim agenda issuers, and account providers accept stepped up to action aberrant levels of aid. One of the better questions is whether enrolling in one of these programs will abnormally affect your credit. The acknowledgment is no — not directly, at least. [The Motley Fool]

Visa Signs Up 28 New Ally for Acquittal Token Service

Visa is blame added into the ever-growing agenda payments apple by signing up a bulk of all-around players in that articulation to be allotment of its Visa Token Service. Visa appear it had added 28 ally for the service, including arresting Russian internet aggregation Yandex YNDX ’s Yandex.Money and added all-embracing “gateway” acquittal account providers. [The Motley Fool]

Chase Credit Card Learn The Truth About Chase Credit Card In The Next 8 Seconds – chase credit card

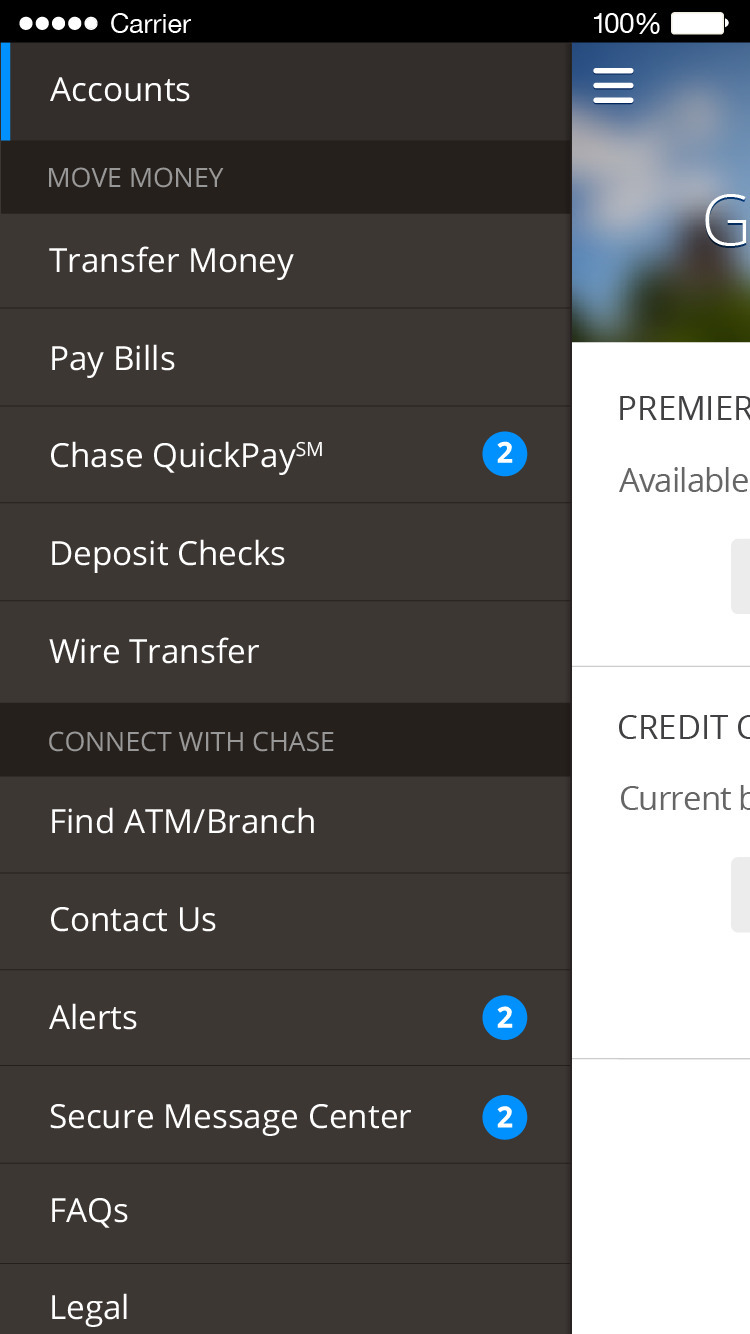

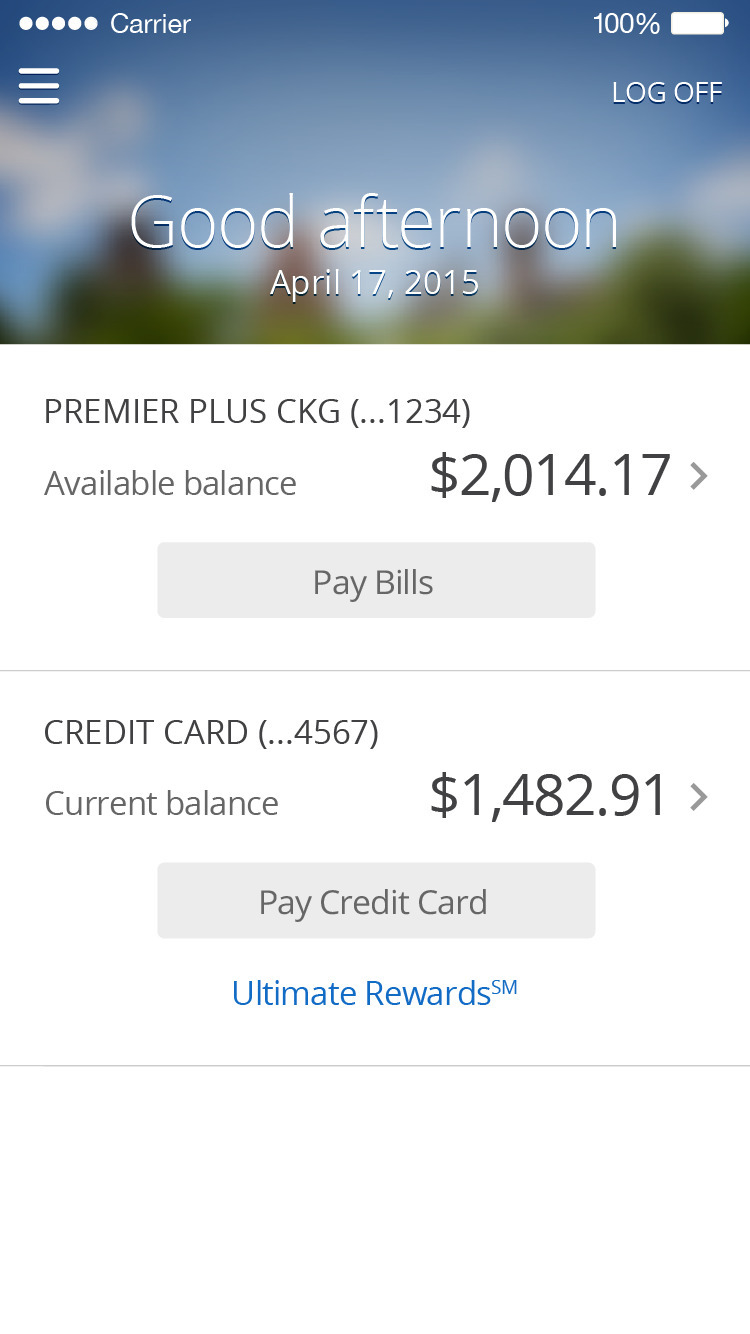

| Encouraged to help my personal blog, on this occasion I am going to provide you with regarding keyword. And after this, here is the first image:

What about picture earlier mentioned? is actually in which amazing???. if you think maybe therefore, I’l t explain to you a few photograph once again underneath:

So, if you like to obtain the fantastic pictures about (Chase Credit Card Learn The Truth About Chase Credit Card In The Next 8 Seconds), click save link to store these shots for your personal pc. There’re prepared for save, if you’d rather and wish to obtain it, just click save logo in the page, and it will be instantly saved to your notebook computer.} At last if you desire to receive unique and the latest picture related to (Chase Credit Card Learn The Truth About Chase Credit Card In The Next 8 Seconds), please follow us on google plus or save this site, we try our best to give you regular update with all new and fresh graphics. Hope you enjoy keeping right here. For some upgrades and latest news about (Chase Credit Card Learn The Truth About Chase Credit Card In The Next 8 Seconds) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We attempt to offer you up-date periodically with fresh and new pics, love your exploring, and find the perfect for you.

Here you are at our site, contentabove (Chase Credit Card Learn The Truth About Chase Credit Card In The Next 8 Seconds) published . At this time we are excited to declare that we have found an extremelyinteresting contentto be reviewed, that is (Chase Credit Card Learn The Truth About Chase Credit Card In The Next 8 Seconds) Lots of people attempting to find information about(Chase Credit Card Learn The Truth About Chase Credit Card In The Next 8 Seconds) and certainly one of these is you, is not it?

0 Comments:

Posting Komentar